News

Insights from the European Investor Dialogue on Energy

The European Investor Dialogue on Energy held on 23-01-2024 brought together public and private investors in the energy sector. Organized by DG Energy, this initiative, consisting of 5 working groups, hosted representatives from investment groups, large corporations, and public institutions. The plenary meeting provided an opportunity for working group members to present their conclusions, setting the stage for a discussion on the future of energy transition.

For the first time, the dialogue invited stakeholders from the cooperative movement to take the stage. Represented by its coordinator Stanislas d'Herbemont from REScoop.eu and Santiago Ochoa de Eribethe from the energy cooperative Gioener, the ACCE project presented its work and engaged in discussions surrounding the intricate landscape of energy finance.

In this blog, we present the key takeaways of the dialogue, as well as some REScoop.eu recommendations.

European financing programs

Commission Kadri opened the plenary, emphasizing the crucial role of private investors in bridging the gap in delivering the energy transition. The discussion delved into key flagship financing programs, particularly those implemented through the Rapid Response Fund (RRF) funding. Our participation in the dialogue focused on local market players, where we explored the needs and opportunities that energy communities and municipalities represent for achieving a decentralized energy transition.

Cooperative movement breaking ground

The inclusion of the cooperative movement in this platform marked a significant milestone. It highlighted the distinct focus and personality of cooperative investors compared to traditional venture capital. Despite differences, common ground emerged during discussions. The Investor Dialogue's WG5 report on barriers to the financing of prosumers and services, emphasized the need for dedicated financing tools for energy communities. Moreover, the private investment community advocated for hybrid schemes, implemented by the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) to address the financing gap in renewable investments.

Key recommendations for financing energy communities

Building on these insights, REScoop.eu, the European federation of citizen energy cooperative formulates several key recommendations for financing energy communities across Europe:

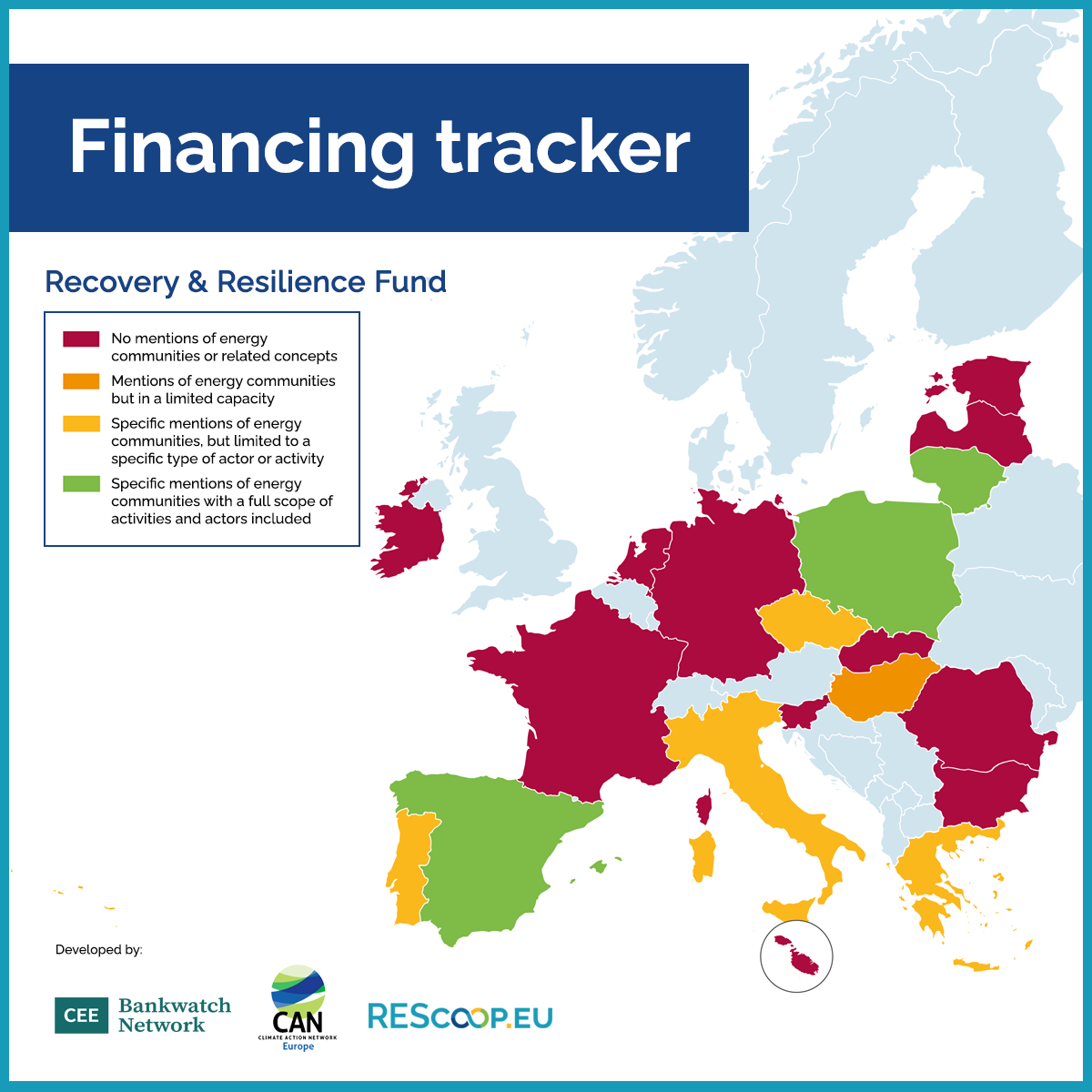

- Create dedicated tools and support programs: EU funding streams provide an opportunity for public authorities to establish dedicated tools supporting the development of energy communities. Notable examples include the program initiated by the Emilia-Romana regional authority in Italy, utilizing cohesion funds. Consult our finance tracker that assesses whether and how EU public funds (Recovery & Resilience, Cohesion, and Modernisation Funds) are being used by Member States to support energy communities.

- Leverage energy community networks: Collaborative networks, exemplified by the Realisatie Fund from Energie Samen in the Netherlands, play a crucial role in identifying and assessing community projects swiftly. Collaboration with ethical banks creates a portfolio effect, enhancing the impact of these projects.

- Energy community projects need to be considered in a holistic approach of the investment rather than its pure financial performance: Recognizing the unique characteristics of energy communities, assessing their success must go beyond financial metrics. Dedicated labels, like the Energie Partagée label in France, help investors understand the broader co-benefits and values associated with community projects.

- Create local partnerships and clarify expectations: Given their focus on local development, energy communities make ideal partners for renewables and efficiency programs. Clear expectations and rules of engagement, as demonstrated by the work of Energy Partagée in France, facilitate successful co-development initiatives between citizen-led initiatives and public/private developers.

Looking ahead

The LIFE ACCE project, exploring solutions aligned with these principles, anticipates valuable insights from its replication sites. The hope is to contribute to ongoing discussions within the expert group and further advance the collaborative efforts initiated by the Investor Dialogue on Energy.